Byju’s, India’s maximum valued personal net company, on July 26 stated it has received upskilling platform Great Learning for $six hundred million and that it’ll invest $four hundred million greater on this section, because it appears to make bigger its training offerings globally throughout classes.

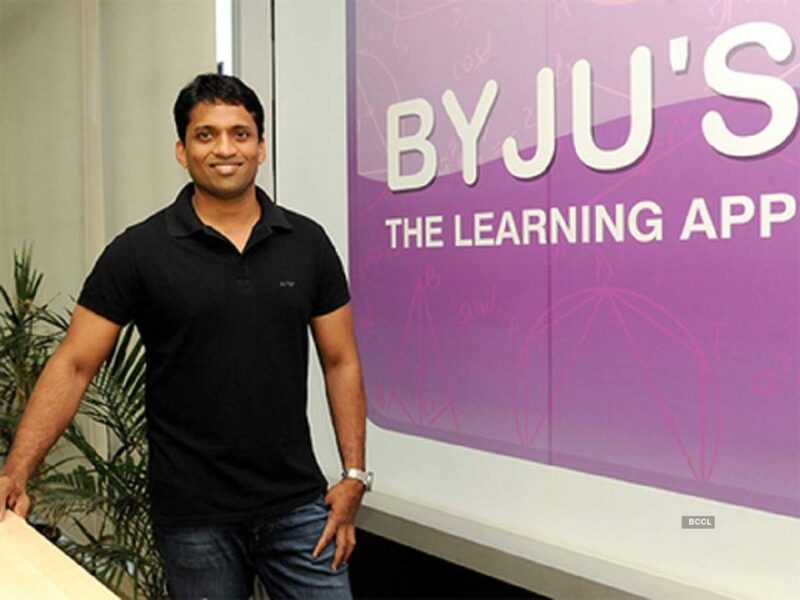

The acquisition is the modern step via way of means of Byju Raveendran, its billionaire founder and CEO, toward taking Byju’s public withinside the subsequent 12-18 months. Byju’s is open to list in India or the United States or each, Raveendran advised Moneycontrol in an interview.

The coins and inventory deal, with a few destiny payout deliberate too, is Byju’s fourth acquisition this yr and could assist make bigger its services past the K12 (kindergarten to twelfth grade) and take a look at prep segments into the expert upskilling area, wherein corporations like Eruditus and UpGrad are constructing extensive groups too.

“This will allow us to go into a brand new area that has very excessive ability in phrases of the opportunity. It is a especially aggressive area however they had been capable of create some thing this is very efficient,” Raveendran stated.

Great Learning has tied up with establishments along with Stanford University, MIT, National University Singapore, IIT Bombay, and Great Lakes Institute of Management to provide packages in regions along with Business Analytics, Data Science, Machine Learning, Cyber Security, and Digital Marketing. It gives those packages in each study room and on-line mode and claims to have impacted over 1.five million experts and college students from one hundred seventy international locations, with a final touch price of over 90%.

Founded in 2013 via way of means of Mohan Lakhamraju, the previous India head of hedge fund Tiger Global, Hari Krishnan Nair, and Arjun Nair, Great Learning is boot-strapped and has crossed a sales run price of $a hundred million in FY21. It will hold to perform as an impartial unit beneathneath the Byju’s Group, with its founding crew staying on.

Other Indian ed-tech businesses that concentrate on this section encompass Eruditus, Simplilearn, and Upgrad. Eruditus and Byju’s each remember Sequoia and different traders in common.

Great Learning is the modern in a spree of acquisitions that Byju’s has made withinside the final yr, because it appears to consolidate its management withinside the on-line and offline mastering area throughout classes and exceptional geographies.

It comes per week after Byju’s received US-primarily based totally analyzing platform Epic for $500 million, as a part of which it additionally introduced a $1 billion funding in North America, supposedly one in all its largest markets. Its different US-focussed acquisitions encompass instructional video games maker Osmo and coding startup WhiteHat Jr. It currently released Future School, an internet one-on-one stay mastering platform for math and coding aimed toward international locations along with the United States, UK, Brazil, Mexico, and Indonesia.

Byju’s prolonged buying spree has brought on shock, awe, or even memes at the lengths that Byju’s will visit cement its management. Social media customers as an example joked if Byju’s will now begin shopping for authorities-run country wide forums of training and if it is India’s solution to Thrasio- with its bold residence of brands.

“The reality that it’s far a meme manner I do not want to have a reaction. The training area remains beneathneath-invested”, he stated

Byju’s acquisitions also are in lockstep with an ongoing fundraising round, which can come to be at $1.25 billion. As a part of this, it currently raised $350 million from UBS, Blackstone, ADQ, Phoenix Rising & Zoom founder Eric Yuan, at a valuation of $16.five Billion, making it India’s maximum precious unicorn. According to facts from CB Insights, Byju’s is now the eleventh maximum precious startup withinside the world. Its sales doubled withinside the pandemic yr as greater college students trusted on-line training and stood at Rs five,six hundred crore for the yr ended March 2021.

The investor urge for food in Byju’s comes amid a investment increase withinside the Indian startup atmosphere and a hurry of Internet IPOs. While Zomato’s public list obtained an awesome response, different unicorns that plan to listing in India this yr encompass Paytm, PolicyBazaar, Nykaa, and Delhivery.

“It is ideal to peer traders valuing growth. But our timelines aren’t primarily based totally on others. We are open to list in India or the United States and could examine it in 12-18 months,” he stated.

Raveendran additionally sees possibilities for Indian edtech startups open up similarly given the crackdown via way of means of Chinese regulators on their local edtech businesses. The Chinese authorities stated those venture-funded training corporations have to be dealt with as now no longer-for-earnings corporations, and the personal ones will now no longer be capable of listing. The indexed techs noticed their inventory costs crash over 70%, sounding a death-knell to an energetic sector.

“I nonetheless trust those businesses are the purpose why China have become a force. This may become a bonus for India, as greater traders may come here,” Raveendran stated.