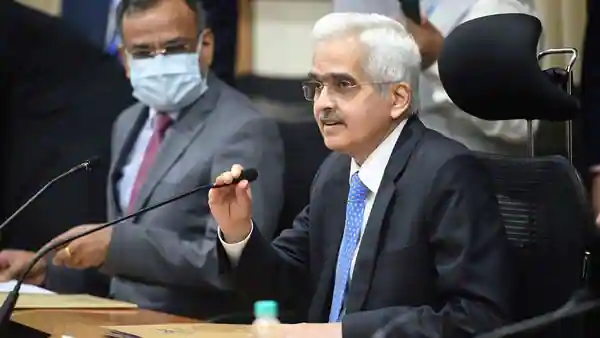

In the midst of concerns that are blazing over price increases, Bank Indian (RBI) reserves Governor Shaktikanta Das said that although inflation is moderated and flat since April, it remains “uncomfortable and uncomfortable”.

According to a statement issued on Friday, DAS made a statement at the meeting of the Monetary Policy Committee (MPC) held between 3 and 5 August.

He said that since the last MPC meeting in June, there has been a significant slowdown in the global economy but it is likely to grow only 3.2 percent in 2022 according to the International Monetary Fund (IMF).

“At the same time, global inflation has hardened further and is projected to continue to increase and last longer around 6.6 percent for the developed economy (AE) and 9.5 percent for developing and developing economy markets (EMDes) (IMF, July 2022), “Das said in the statement.

He added that in the domestic front, “even though inflation has been moderated and the highlands since the peak is recently April 2022, it remains unacceptable and uncomfortable”.

The high inflation rate continues to be wide-based with 13 of 23 CPI sub-groups/groups, consisting of nearly 60 percent of the CPI basket, registering more than 6 percent of inflation in June 2022. In the future, although it is there is an initial indication that inflation is possible Has peaked in April, significant uncertainty remains due to adverse global abundance that comes from boiling geopolitical tension, easily volatile global commodity prices and financial markets, “said the Governor of RBI.

Furthermore Das said that apart from the hope that releasing global food and industrial metals will reduce import inflation, the appreciation of the US dollar can “offset some of the benefits”. He said an increase in living costs could also trigger a wage price spiral.

High -sustainable inflation, unless it is handled effectively, can result in the neglect of inflation expectations and their second sequence effect. This requires a proper monetary policy response to prevent upward deviations in inflation from the target level, “Das added.

During the meeting, MPC decided to increase the level of policy repo under the liquidity adjustment facility (LAF) by 50 basis points to 5.40 percent with direct effects. Standing Deposit Facility (SDF) fares were established according to 5.15 percent and marginal standing facilities (MSF) and bank tariffs to 5.65 percent.

MPC also decided to remain focused on withdrawing accommodation to ensure that inflation remains in the target that will occur, while supporting growth and development.

The 37th MPC meeting was attended by all committee members, including Shashanka Bhide, Senior Honorary Advisor, National Applied Economic Research Council, Delhi; Rajiv Ranjan, Executive Director (Reserve Bank Officer nominated by the Central Council based on Section 45ZB (2) (c) from Bank India Reserves, 1934); Michael Dabatrata Patra, Deputy Governor responsible for monetary policy, among others. Das chaired the meeting.