Search GST Number: Search your GSTIN of the Taxpayer number everywhere India, Just type your GST number below and check name and address of the GSTIN / UIN holder.

The registration under GST is Permanent Account Number (PAN) based and state-specific. GST number (GSTIN) may be a 15-digit number and a certificate of registration, incorporating the GSTIN is formed available to the applicant upon registration

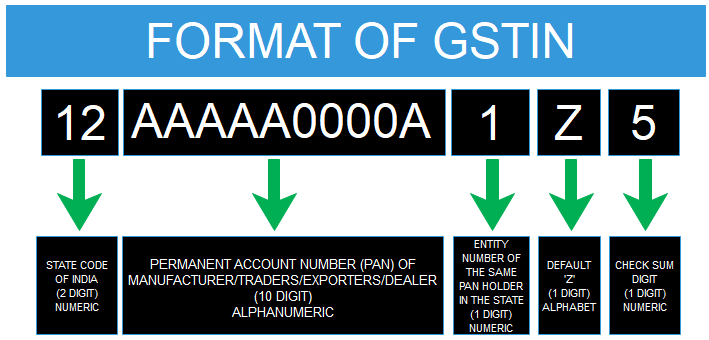

- The first two digits of this number will represent the state code

- The next ten digits will be the PAN number of the taxpayer

- The thirteenth digit will be assigned based on the number of registrations within a state

- The fourteenth digit will be Z by default

- The last digit will be for check code

Each taxpayer is assigned a state-wise PAN-based 15 – digit Goods and Services Taxpayer number (GSTIN).

Structure of GSTIN

Registration under GST isn’t tax specific, which suggests that there’s single registration for all the taxes i.e. CGST, SGST/UTGST, IGST and cesses. A given PAN based legal entity would have one GSTIN per State, meaning a business entity having its branches in multiple States will need to take separate State wise registration for the branches in several States.

But within a State, an entity with different branches would have single registration wherein it can declare one place as principal place of business and other branches as additional place of business. However, a business entity having separate business verticals (as defined in section 2 (18) of the CGST Act, 2017) during a state may obtain separate registration for every of its business verticals.