The Reserve Bank of India( RBI) has failed to meet its price accreditation, with the rearmost Consumer Price indicator( CPI) affectation for September attesting a third straight quarter in which average affectation has stayed outside the forbearance band of 2- 6 percent.

According to data released by the Ministry of Statistics and Programme perpetration on October 12, caption retail affectation rose to7.41 percent in September from7.00 percent in August.At7.41 percent, the September CPI affectation figure is slightly above the agreement estimate. As per a Moneycontrol bean, CPI affectation was seen rising to7.3 percent.

moment’s affectation print means affectation has now spent 36 successive months- or three full times- above the RBI’s medium- term target of 4 percent. More importantly, affectation has been outside the commanded 2- 6 percent forbearance range for three successive diggings, which is the description of failure under the flexible affectation targeting frame.CPI affectation equaled 6.3 percent in January- March,7.3 percent in April- June, and now 7 percent in July- September.

As per the law, the RBI must now submit a report to the central government explaining why it failed, the remedial conduct it proposes to take, and the time period within which affectation will return to target.

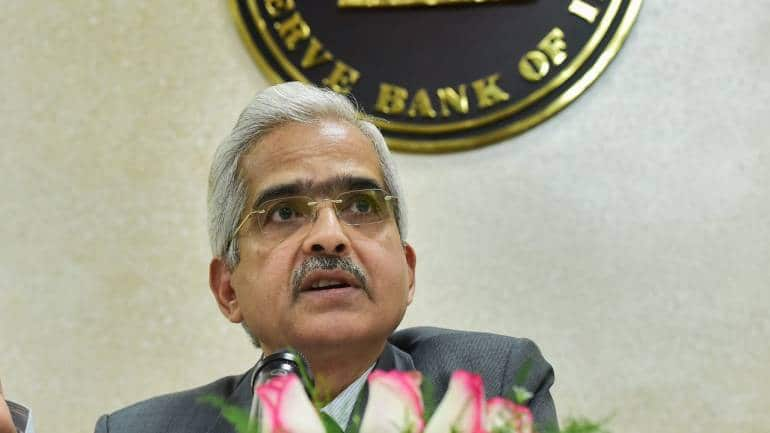

In thepost-policy press conference on September 30, Governor Shaktikanta Das had said the Monetary Policy Committee( MPC) would meet to bandy the RBI’s report to the government.

So, what we will write, I’ll not say. But as I’ve said before, we’re awaiting the affectation to come down near to the target over a two- time cycle, that was our anticipation before and indeed now,” Das had added.The RBI’s most recent cast sees CPI affectation comprising6.7 percent in FY23 before dropping to5.2 percent in FY24.