incometaxefiling: ITR Filing for AY 2020-21 is started from April 2020, here we offer complete guidance for E-File tax Return Online 2020-21. incometaxindiaefiling.gov.in is official website for filing tax returns in India, Please check complete Guide for a way to File tax Return Online for AY 2020-21 at incometaxindiaefiling.gov.in portal. File ITR Online for AY 2020-21. By Using This Guide Every Student are ready to E-File tax Return Without Using Any tax or CA Software.

Every One Know Cost of CA Software or tax Return Software is extremely high and that we don’t ready to maintain these softwares. So Today we offer A Full Guide and Procedure for E-Filing tax Return Online. Recently we offer the way to Pay TDS Online Full Guide and Procedure, and every one Due Dates of tax .

incometaxefiling – E-File Income Tax Return Online

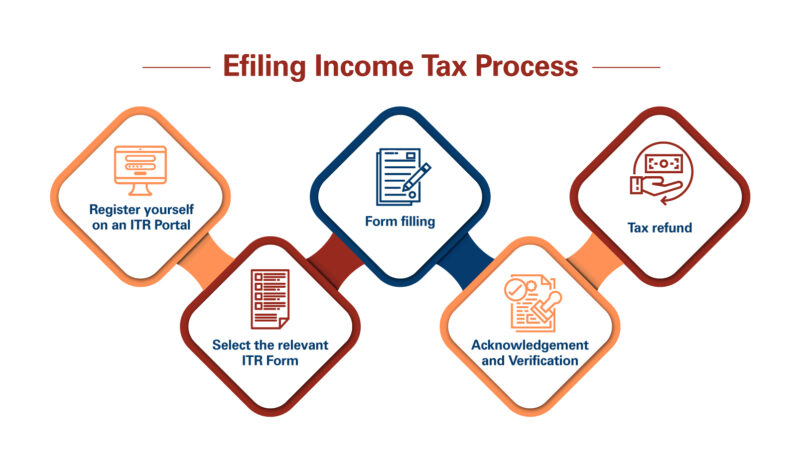

Income Tax efiling are often easily done on the web portal of tax Department by following these 6 simple steps without incurring any cost. so as to assist save time and efforts, tax Department of India now allows tax payers to e-file there returns online. the convenience of e filing tax has made this online process ever-so-popular with tax payers.

Steps to e-File Online ITR (ITR 1 and ITR 4S):

- www.incometaxindiaefiling.gov.in e-Filing Home Page

- Login using e-Filing user credentials

- Navigate to “e-File” Tab –> Click on “Prepare and Submit Online ITR”

- Select “ITR Form Name” from the drop down (ITR-1 or ITR-4S)

- Select “Assessment Year” –> Select the Radio button “Prefill Address with” to auto populate the address –> Select the Radio button if DSC is applicable –> Click on “Submit”

- Enter the mandatory details in the online form –> Click on “Submit”

To upload Income Tax Form by Tax Professional:

The taxpayer (Client) has got to add a specific CA for upload of particular audit form. Post which the CA has got to login into his account and download required Audit Form. After updating, the CA has got to upload the Audit form using CA login.

A request will be sent to Taxpayer of such upload done by the CA. The taxpayer can view the same under “Work List” option after login with taxpayer’s login credentials.