Introduction

Harshad mehta bull run rajkotupdates news : of financial history, the name Harshad Mehta resonates as a legendary figure who orchestrated a remarkable phenomenon known as the Harshad Mehta Bull Run. This article delves into the intriguing tale of how Harshad Mehta, an Indian stockbroker, masterminded a financial upsurge that left an indelible mark on the country’s economy.

Also read : https://businessclickstoday.com/us-inflation-jumped-7-5-in-in-40-years-rajkotupdates-news/

The Rise of Harshad Mehta

Early Life and Career

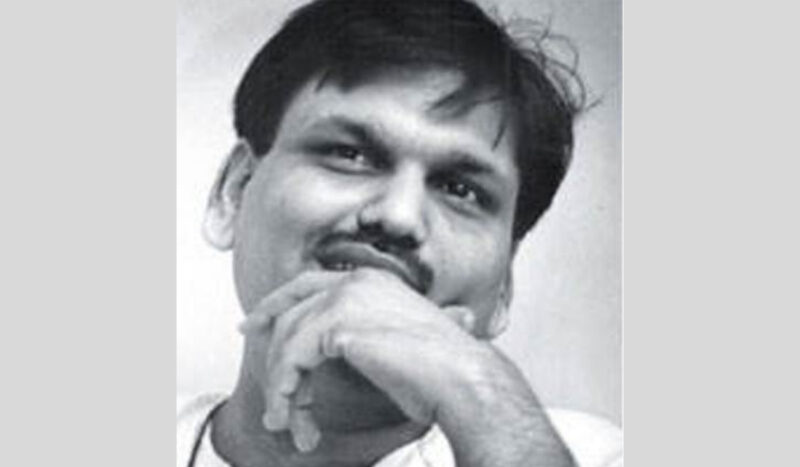

Harshad Mehta, born in 1954, emerged from humble beginnings in Rajkot, India. Despite facing initial setbacks, he displayed a tenacious spirit and entered the world of stockbroking in the late 1970s. His deep understanding of the stock market and charismatic persona soon set him apart in the industry.

Mastering the Art of Stock Manipulation

During the late 1980s and early 1990s, Mehta devised an ingenious scheme to manipulate the stock market. Leveraging the loopholes in the banking system, he exploited the practice of using bank receipts to inflate the market demand for certain stocks. This tactic, later termed “the Big Bull” strategy, allowed Mehta to artificially inflate stock prices and profit immensely.

The Harshad Mehta Bull Run Unveiled

The Stock Market Frenzy

Mehta’s manipulative tactics Harshad mehta bull run rajkotupdates news : led to a colossal surge in stock prices, driving an unprecedented bull run in the Indian stock market. Stocks soared to dizzying heights, and investors reaped substantial profits. The success of this scheme attracted widespread attention and thousands of new investors rushed to join the frenzy.

The Mirage of Wealth

While the bull run promised immense wealth, it was built on a foundation of deception. The inflated stock prices were unsustainable, and Mehta’s manipulative practices were bound to collapse. Unfortunately, many investors were unaware of the impending disaster and invested their life savings, only to face devastating losses.

The Fallout and Legal Battles

As the artificially inflated stocks plummeted, panic ensued in the market. The regulatory authorities took notice, and Harshad Mehta found himself entangled in a web of legal battles. His empire crumbled, and he faced charges of financial fraud and securities manipulation. The subsequent investigation laid bare the extent of his deception.

The Legacy of the Harshad Mehta Bull Run

Reforms in the Financial System

The Harshad Mehta episode served as a wake-up call for the Indian financial system. In the aftermath of the scandal, reforms were initiated to closeHarshad mehta bull run rajkotupdates news : the regulatory gaps that had allowed such manipulation to occur. Stricter guidelines were put in place to prevent similar incidents in the future.

Lessons Learned

The Harshad Mehta Bull Run stands as a cautionary tale about the dangers of unchecked greed and manipulation in the financial world. It highlighted the need for transparency, accountability, and ethical conduct in financial markets.

Conclusion

rajkotupdates news : The Harshad Mehta Bull Run remains a pivotal chapter in India’s financial history, symbolizing both the heights of human ambition and the depths of financial misconduct. Harshad Mehta’s meteoric rise and subsequent fall serve as a reminder that the pursuit of wealth must be underpinned by integrity and ethical values.

FAQs

1. What was the Harshad Mehta Bull Run?

The Harshad Mehta Bull Run refers to a period in the Indian stock market during the late 1980s and early 1990s, characterized by a sharp and artificial rise in stock prices orchestrated by stockbroker Harshad Mehta.

2. How did Harshad Mehta manipulate the stock market?

Harshad Mehta used a tactic known as the “Big Bull” strategy, inflating stock prices by exploiting banking system loopholes and manipulating bank receipts.

3. What were the consequences of the bull run?

The bull run led to a market frenzy and attracted numerous investors, but it ultimately resulted in a market crash, financial losses, and legal battles due to Mehta’s fraudulent practices.

4. What reforms were introduced after the scandal?

In the aftermath of the scandal, financial reforms were implemented in India to strengthen regulatory oversight, enhance transparency, and prevent future instances of market manipulation.

5. What lessons can be learned from the Harshad Mehta episode?

The episode underscores the importance of ethical conduct, regulatory vigilance, and responsible investing, reminding us that unchecked ambition and manipulation can have far-reaching consequences in the financial world.