E-way login at ewaybill.nic.in, Guide for Opening the e-Way Bill System. inspect step by step guide for a way to login at GST E-way bill Portal with screenshots. e-way bill may be a document required to be carried by an individual responsible of the conveyance carrying any consignment of products useful exceeding fifty thousand rupees as mandated by the govt in terms of section 68 of the products and Services Tax Act read with rule 138 of the principles framed thereunder. it’s generated from the GST Common Portal by the registered persons or transporters who causes movement of products of consignment before commencement of such movement.

Why is that the e-Way Bill required?

Section 68 of the products and Services Tax Act mandates that the govt may require the person responsible of a conveyance carrying any consignment of products useful exceeding such amount as could also be specified to hold with him such documents and such devices as could also be prescribed. Rule 138 of Karnataka Goods and Services Tax Rules, 2017 prescribes e-way bill because the document to be carried for the consignment of products useful quite rupees fifty thousand .

Government has issued a notification under rule 138 of products and Services Tax Rules, 2017 mandating to hold e-way bill for transportation of products of consignment useful quite rupees fifty thousand. Hence e-way bill generated from the common portal is required to be carried.

Logging into e-Way Bill System

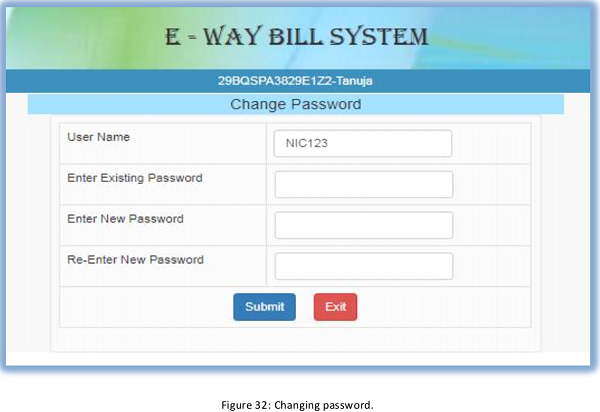

To open or login to the e-Way Bill system, user should have registered within the e-Way Bill system, if he’s the GSTIN holder or he should have enrolled within the e-Way Bill system, if he’s GST un-registered transporter. The user can read the our last post to understand the way to register or enrol into the e-Way Bill system.

The user has got to open the e-Way Bill portal and enter his username and password along side the displayed captcha. On successful authentication, the system shows him the most menu of the eWay Bill System.

Main Menu after E-way login

On the left hand side, the system shows the main options. They are:

- e-Way bill – It has sub-options for generating, updating, cancelling and printing the e-Way Bill.

- Consolidated e-Way Bill – It has sub-options to consolidate the e-Way Bills, updating and cancelling them.

- Reject – It has the option to reject the e-Way Bill generated by others, if it does not belong to the user.

- Reports – It has sub-options for generating various kinds of reports.

- Masters – It has sub-options to create the users’ masters like customers, suppliers, products, transporters.

- User Management – It has sub-options for the users to create, modify and freeze the sub-users to his business.

- Registration – It has sub-options to register for SMS, Android App and API facilities to use.