Andhra Bank NEFT Form 2020: National Electronic Funds Transfer (NEFT Online Funds Transfer to other banks) Called AB Xpress. With National Electronic Funds Transfer you’ll transfer funds and make mastercard payments to any bank across India. With this service your transactions are easier, and, with fewer restrictions, they reach further than before.

What is NEFT?

National Electronic Funds Transfer (NEFT) may be a funds transfer mechanism where transfer of cash takes place from one bank to a different on an equivalent day . In other words, this is often an electronic payment processing environment wherein transactions are settled as soon as they’re processed.

How to Send Payment via NEFT

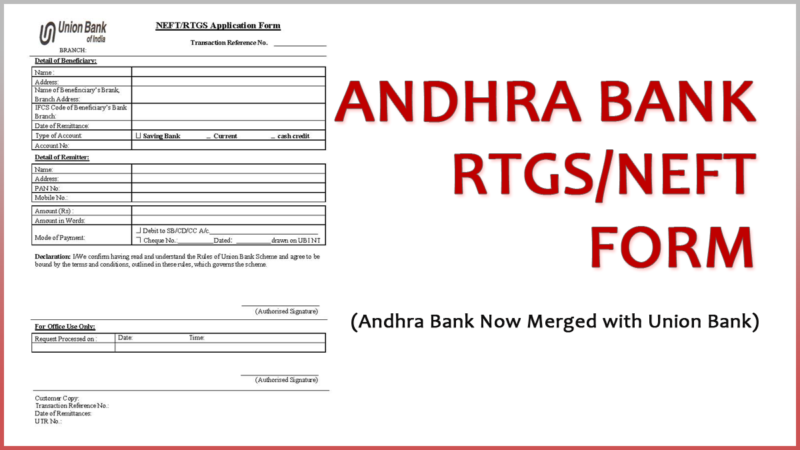

There are two ways to send payment via NEFT and one among them is 1. NEFT via Online Internet Banking and 2nd is 2. NEFT via Bank Branch Do NEFT via Bank Branch : If you would like to form NEFT via offline mode i.e from Bank Branch then you would like to go to your nearest Andhra Bank Branch and Request for NEFT Form or Slip and Fill all the require details asked in NEFT Form and undergo Cashier, Now you bank brach send payment to a different person within 2 working hours

Do NEFT Via Internet Banking : you’ll also send money via NEFT by using your Andhra Bank Internet Banking Service, for using Internet banking, you would like to login at Andhra Bank Website then you’ll require to feature new Beneficiary then you’re ready to make payment via NEFT. Online NEFT is enabled for all customers of Andhra Bank (Internet Banking) with full transaction right. If you’d wish to avail Andhra Bank NEFT Facility then please download the appliance form or visit to your Andhra Bank Brach and submit the duly filled form to your base branch. If you’re already a Andhra Bank Connect customer with “view right” and would really like to avail full transaction right, please resubmit your form (can download from above URL) to you base branch.

What the customer must have for remittance

IFSC of the bank branch to which the remittance to be made (IFSC is 11 characters code)

Beneficiary account number, Name and Address (to whom the remittance is meant to )

Approach the branch with the above details

How to get the IFSC of the branch

Indian economic system Code (IFSC) means a singular code of 11 digits of NEFT/RTGS enabled Branches. Normally, this code are going to be printed on the cheque books OR it’s going to be obtained from the branch where the account is maintained. it’s also available on the RBI website. just in case the IFSC of the beneficiary bank isn’t known, an equivalent are often obtained by selecting the Bank and Branch while registering the beneficiary.

How to get the IFSC of the branch

Outward : While remitting the funds, Account Number of the beneficiary is to be mentioned correctly in the voucher (to whom the remittance is intended to ).

Inward : While seeking remittance from other bank Customers it is mandatory to quote your 15 Digit Finacle Account Number compulsorily.

What is the Benefits of Andhra Bank NEFT

- Andhra Bank NEFT is Available to all – All our Net banking (existing & new) users are eligible to utilize this on-line facility.

- Andhra Bank NEFT Facility is simple, convenient, quick and secure – Users can transfer funds to the beneficiaries in other banks in a simple, convenient and seamless manner. Funds transfer to other banks is faster, secure and safe

- Customers can use Andhra Bank NEFT Anytime, anywhere… Simple and easy to operate – from home / office anytime, anywhere, Save time and energy

- Get more for less – Andhra Bank NEFT cost less than the conventional modes of remittance such as DD/MT