Volvo 9600 Intercity Sleeper Bus Launched

With the aim of breaking the very unorganized domestic Sleeper Intercity bus market, Volvo Buras India, a commercial VE (VECV) division, has launched the Volvo 9600 platform, which will support the sleeping trainer installed in the factory and the coach is set in 15 meters 6×2 and Configuration 4×2 13.5 meters. The new bus will be valued in the range of RS 1.3 Crore to RS. 2 crore, depending on the specifications and level of customization. State transportation companies and private fleet operators are targeted customers from new models. .

The government withdraws the Data Protection Bill from Lok Sabha

The bill, drawn by Minister IT Ashwini Vaishnaw, aims to provide digital privacy protection to individuals relating to their personal data, determine the flow and use of data, and create trust relations between people and entities that process data.

Indigo CEO Rono Dutta: Always see income maximizing

We are present at all Pre-Covid international destinations except China, Hong Kong, Myanmar. We will add wherever we can performance. Markets like Srinagar, Bagdogra, Goa do it very well.

AU Small Finance Bank launches QIP ## AU Small Finance Bank Launches Qip

On July 20, the Company Council agreed to collect funds based on the issue of equity shares for the number of aggregates that did not exceed the 3,000 crore hospital through personal placement, QIP, preference or through a combination of it or any alternative mode. The official announcement on August 3 did not determine the exact quantum that was sought to be raised.

ASUS launches a new ZenBook and Vivobook laptop in India

ZenBook Flip 14 will be available online on E-Shop, Amazon, and Flipkart Asus. It will also be available offline at the ASUS brand store and official reseller. The laptop starts from the hospital. 99,990

Kunal Shah, Senior Technical Analyst at LKP Securities:

Bank Nifty index before the RBI policy witnessed sideways and ended in a flat tone. The index needs to be closed above 38,200 for the continuation of the uptrend to the 38,500-38,700 zone level.

The downside index support was established in 37500 and if violated it would witness further sales pressure towards zone 37,000. The index will provide a clear direction after the policy is announced.

Shrikant Chouhan, Head of Equity Research (Retail), Securities Box Ltd

Bulls and Bears slipped out in unstable charged sessions, but finally the first to maintain their victory at Dalal Street to buy in it & select financial shares. Even when FII bought into local equity, it was continued after a 3 -month break, traders took a special approach to the RBI tariff decision on Friday.

Technically, on the intraday graph, nifty has formed a dual lower formation and bullish candles on a daily graph that is widely positive.

We have the view that 17200 and 17300 will be the main support zone for traders. As long as the index is traded above, the uptrend texture is likely to continue. On it, it can move up to 17500-17550. On the other hand, for the following traders and position trends, 17200 will be a level of sacred support.

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty continues to be higher inch along with the Bollinger band over the daily that develops. After floating near Retracement 61.8% of all declines from October 2021 to June 2022 (eg near 17300) for the last few sessions, this index stretches higher. This is a little far from the next target of 17500, which is 78.6% of April -June.

After being tested, the nifty is expected to enter short -term consolidation mode. Short-term support zone shifts higher to 17150-17200. Thus short -term traders can maintain a long position with reversal that are left behind up to 17150. However, they must be very careful about their exposure at the wider end of the market & need to reduce the exposure there.

S. Hariharan, Trading Sales, Emkay Global Financial Services:

The market has recovered strongly with a change of foreign investor flow track – the last 4 sessions have seen FPI’s entry flow nearly 1 billion. The pivot felt in the Fed and Cooling Tightening Cycle from the price of crude oil has made the macro environment more profitable for India, who have outperformed EM and Asian colleagues by 6% in the past week.

Banks and cars have withdrawn the strongest flow while it has become the underprivileged. In the future, the gap in the assessment between the emerging nifty and MSCI market index, as well as the gap between the results of income from good G-SEC results vs 10 years, will be a detrimental factor and we can expect market returns to be better muted. Tugging to technical support at an average transfer of 200 days in 17,000 is possible.

Vinod Nair, Head of Research in Geojit Financial Services:

In the midst of geopolitical storms that affect the global market, the domestic market moves in line with its global colleagues. The global market is also concerned with the risk of recession.

In the domestic front, the main trigger this week is the result of RBI policy meetings, where the market mostly expects a tariff increase of 25-50bps.

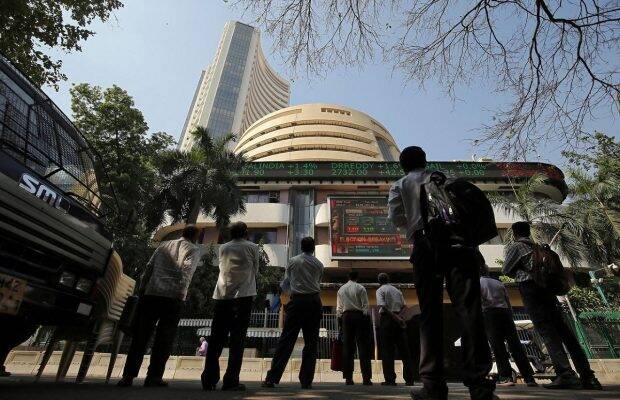

Market Close: The benchmark index ended higher in a very volatile session on August 3 with nifty around 17,400.

At close, Sensex rose 214.17 points or 0.37% at 58,350.53, and nifty rose 42.70 points or 0.25% at 17,388.20. Around 1337 shares have advanced, 1934 shares declined, and 133 shares did not change.

Tech Mahindra, TCS, Infosys, Asia Paints and Titan Company are among the main winners in Nifty. The Losers include Maruti Suzuki, Sun Pharma, Tata Motors, Mahindra Bank Box and Indian Coal.

Except information technology all other sectoral indexes ended in red.

The BSE midcap index fell 0.6 percent and the smallcap index fell 0.28 percent.