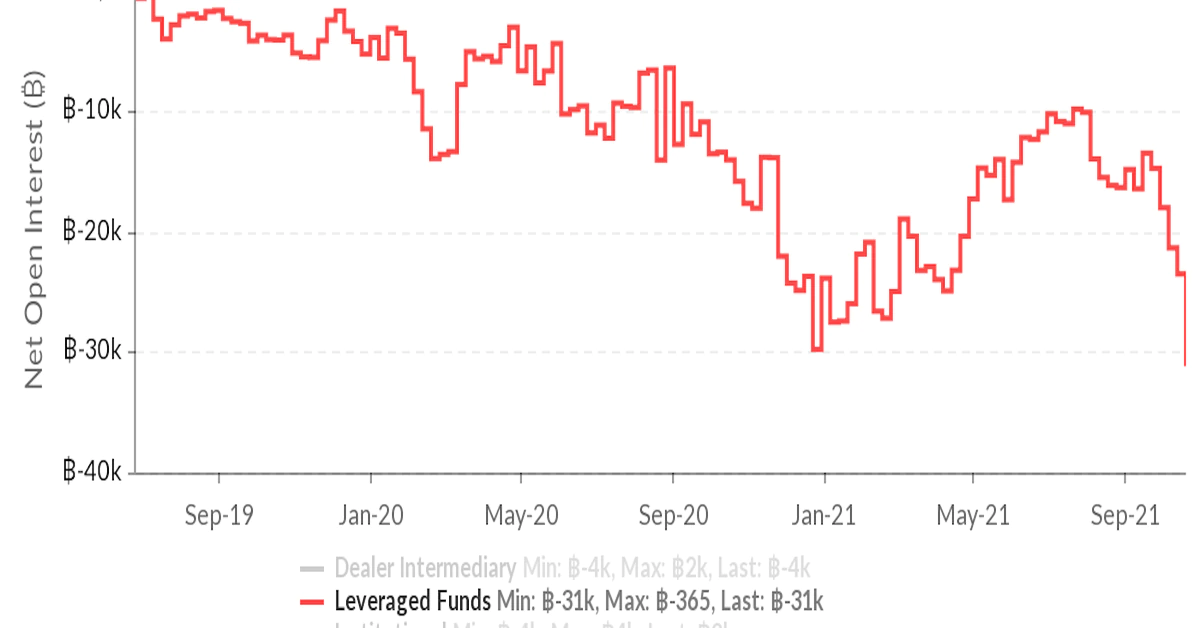

Leveraged finances on the Chicago Mercantile Exchange (CME) raised their bets against bitcoin to record high in the week endedOct. 19, conceivably to profit from the widening gap between futures and spot requests prices.

The Commodity Futures Trading Commission’s (CFTC) Commitments of Dealers report released on Friday showed leveraged finances held a net short position of contracts in the seven days toOct. 19, marking an increase of from the formerweek.Record films by influence finances doesn’t inescapably mean these dealers had a bearish bias. They may have raised short positions in the futures request and contemporaneously bought the cryptocurrency in the spot request, reserving the so- called carry trade.

The strategy is initiated when futures trade at a notable decoration to the spot price and trades can benefit from an eventual confluence of prices in the twomarkets.The annualized decoration in the front-month bitcoin futures contracts surged from 1 to 20 in the run-up to ProShares’Bitcoin Strategy ETF launch onOct. 18, and was last seen at 13. The three-month rolling decoration also rose from 3 to 16 before tapering to11.7.

ProShares’ETF, which invests in the CME-listed bitcoin futures contracts, made a strong debut last Tuesday on the New York Stock Exchange, while Valkyrie’s futures- grounded ETF went live on Friday.

Before this month, judges had advised of an supplement in futures decoration and renewed interest in cash and carry arbitrage.

CME Leveraged Funds Raise Bets Against Bitcoin to Record High as Futures Premium Spikes